MANILA, Philippines – Students from different universities and organizations gathered on Wednesday, November 22, in the University of the Philippines (UP) Diliman to launch a campaign that urges legislators to back a proposal to increase tobacco tax. (READ: EXPLAINER: Senate, House versions of the tax reform bill)

They wrote letters to undecided senators, hoping to convince them to support the move to raise the levy on so-called “sin” products, especially tobacco. In October 2017, Senator Manny Pacquiao filed Senate Bill No 1599, which seeks to amend Republic Act 10351 or the Sin Tax Reform Act of 2012 aimed at generating more government revenue. The young people went to the Senate on Wednesday afternoon to hand their letters to the legislators.

"For the past months, we went to the Senate building, knocked at the senators' offices, and used the reach of social media to deliver our appeal," Joel Estoesta of the Pamantasan ng Lungsod ng Maynila Economics Society said.

Pass bill in haste

President Rodrigo Duterte earlier vowed to overhaul the country's tax code as part of his economic program. He called on the Senate to "support the tax reform in full and to pass it with haste."

The bill proposes to increase the present unitary excise tax rate to

P60 from P30 per pack. The annual excise tax will also be increased from

4% to 9% (READ: Pacquiao wants to increase cigarette tax to P60 per pack)

Senate Committee on Ways and Means chair senator Juan Edgardo

Angara has not yet expressed commitment to back the bill, according to

the young advocates. Meanwhile, Senator Risa Hontiveros has included

tobacco tax increase in her proposed amendments to the proposed measure.

The rest of the senators are still undecided on the issue. "It is of utmost importance that this measure be included in the first package expected to be passed this year. Failure to do so is tantamount to blocking this reform altogether," UP Economics Towards Consciousness president David Baldivia said.

Better health, more revenue

Pacquiao said that the passage of the measure will at least add P60 to P70 billion to government revenues.The student leaders also highlighted the benefits of increasing tobacco tax aside from saving lives. (READ: Senate files version of tax reform bill seen to exempt 3.2 M Filipinos from income tax)

According to UP Economics Towards Consciousness president David Baldivia, adding tobacco tax into the package will generate around P50 billion in additional funds "that can be used by the government to improve healthcare in the country.

"The evidence is clear. There is no excuse not to prioritize the passage of this measure. The ball is now in the Senate's hands to choose the welfare of the people over the corporate interests. One thing is for sure, the youth is watching," he added.

"One of our movement's main calls is to include tobacco tax in the current tax reform package being discussed in the Senate.

'No-vote media campaign'

The group Youth for Sin Tax also launched a zero vote media campaign to "reject and give zero votes to senators running in 2019 elections who will block the proposal to include tobacco tax increase in tax reform bill."

The 2019 senatorial elections is fast approaching and according to UP Diliman University Student Council chair Benjie Aquino, "those who side with corporate interests over the welfare of the youth do not deserve the votes of the youth in 2019." Incumbent senators who are eligible for reelection include Francis Escudero, Gregorio Honasan, Loren Legarda, Aquilino Pimentel III, and Antonio Trillanes.

"Individually, we may seem small compared to these corporate giants,

but together our voices will be the key towards changing the political

landscape in the country into something better," he said. – Rappler.com

Support Free and Fearless Journalism

When Power insists, “you’re either with us or against us,” the space for a diversity of voices and ideas shrinks.

When hate and anger are weaponized, it creates a spiral of silence.

When critical questions are simplistically equated with an anti-government agenda, it requires courage to hold decision-makers accountable.

We launched Rappler in 2012 to marry the highest standards of journalism with technology to strengthen Philippine democracy.

We didn’t want to just give you the news; we aimed to promote critical thinking, self-reflection, and empathy to encourage informed decision-making.

Help keep us free and independent of political and commercial interests.

When hate and anger are weaponized, it creates a spiral of silence.

When critical questions are simplistically equated with an anti-government agenda, it requires courage to hold decision-makers accountable.

We launched Rappler in 2012 to marry the highest standards of journalism with technology to strengthen Philippine democracy.

We didn’t want to just give you the news; we aimed to promote critical thinking, self-reflection, and empathy to encourage informed decision-making.

Help keep us free and independent of political and commercial interests.

38

DAYS

:

11

HOURS

:

05

MINS

:

28

SECS

P430,000

P5,000,000

9% OF GOAL

#BudgetWatch

DBM: 2018 budget, tax reform bill to be passed by December

Q&A.

DBM Secretary Benjamin E. Diokno talks with media during "Breakfast

with Ben" at the DBM Executive Lounge in Manila. File photo from the DBM

MANILA, Philippines – Budget secretary Benjamin Diokno said he's

hopeful that the 2018 national budget will be approved by December."We are optimistic that the fiscal year 2018 budget will be signed on time. We expect it to be approved on the first week of December," Diokno told reporters on Wednesday, November 22.

The second national budget crafted under the Duterte administration, the proposed P3.77-trillion budget is 12.4% higher than last year. The figure represents 21.6% of the projected gross domestic product (GDP) for 2018.

Under the proposed national budget, education and infrastructure departments receive the lion's share of the pie. (READ: Education, infra to get bulk of proposed 2018 nat'l budget)

Diokno also said "he is confident" that the tax reform bill will be passed into law around the same time. (READ: How will the proposed tax reform package affect Filipinos?)

If passed into law, workers get to have a bigger take-home pay under the proposed tax reform package, but the prices of several commodities will increase.

In an earlier statement, Socioeconomic Secretary Ernesto Pernia also said he is optimistic that the implementation of the tax reform package can begin by January 2018.

Salary hike

Diokno also said that the 3rd tranche of the pay adjustment for government workers will be out by January 2018.

According to the budget chief, the government has set aside P24 billion for the 3rd tranche of the Salary Standardization Law (SSL) and would benefit about 1.2 million government workers.

Diokno said that aside from the increase in pay, government employees will also receive midyear and yearend bonus. (READ: These gov't workers will get P40B in yearend bonuses, cash gifts)

In 2015, former President Benigno Aquino III pushed for the SSL which mandates a 4-year salary increase to the basic salaries of government employees, arguing that government pay is only 55% of market rates.

The last tranche will be out in 2019. – Rappler.com

Senate OKs P250K annual income tax exemption

EXEMPTION. The Senate has approved the higher income tax exemption of P250,000 annually. Photo by Camille Elemia/Rappler

MANILA, Philippines – The Senate on Wednesday, November 22, approved a

higher personal income tax exemption for Filipinos of P250,000

annually, effectively increasing the take-home pay of taxpayers.Senate ways and means committee chair Juan Edgardo Angara said the P250,000 exemption covers all workers, including employees and self-employed, no matter if the income is greater than that. Angara also said the tax burden will be transferred to the rich.

Once approved into law, Filipinos earning P21,000 a month will be exempt from paying income taxes. The exemption approved by the Senate essentially followed the versions of the Department of Finance and the House of Representatives.

“You’ll pay less taxes, bigger exemption. Mas malaki mauuwi (the take-home pay is bigger). It’s available to anybody who earns more than P250,000," Angara told reporters.

The Senate version also retains the P82,000 tax exemption for 13th month pay and other bonuses and the maximum P100,000 additional exemption for up to 4 dependents.

Here is the approved income tax scheme under the current Senate version effective January 1, 2018:

Senate President Pro-Tempore Ralph Recto then proposed the flat P250,000 exemption, which was the exemption that was approved.

Angara also claimed that the current Senate version has exceeded the DOF revenue target of P130 billion, as the measure is supposedly expected to generate P159.5 billion.

The Senate version is still significantly different from that of the House, which has a two-tier tax scheme for personal income tax from 2018 to 2020 and 2021 onwards.

After the Senate passes the bill, both chambers of Congress would have to undergo a bicameral conference committee to thresh out differences between the two versions. – Rappler.com

How to cook bibimbap, lumpia, and other dishes with Angus corned beef

MANILA, Philippines – How much do we love corned beef? Let us count the ways.

Although it’s not a traditional Filipino dish, most of

us grew up enjoying corned beef any time of the day: at breakfast, it’s

fried and paired with fried eggs and garlic fried rice or enjoyed as palaman for pan de sal or slices of tasty bread. At lunch or dinner, it’s usually incorporated in egg torta or cooked with potatoes, either as gisado or as a stew.

Every time we go home to a steaming plate of corned beef

and enjoy bite after bite, we can’t help but remember happy memories

from our youth. We’re easily reminded of how its flavorful, smoky taste

and firm texture, especially if its made from pure, premium meat like

Angus beef, are enough to complete our day.

This is why our love for this classic remains, even as we learn to enjoy cuisine from around the world.

Below are examples of how we can recreate some international dishes with premium Angus corned beef. Here are five dishes from Asia, Europe, and the Americas that you can make at home with a delicious, nostalgic twist:

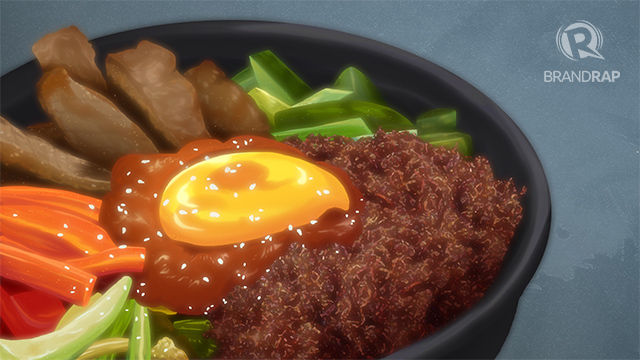

Bibimbap

Bibimbap is a popular, colorful, and healthy Korean dish

often served in a bowl. It’s easy enough to make and enjoy. You can

tweak the ingredients to suit your taste, but the standard usually

includes pre-cooked toppings like bean sprouts, zucchini, cucumber,

spinach, shiitake mushrooms, and fried egg.

Meat is also added, but instead of pork, beef, or

chicken, use a spoon or two of fried corned beef to add another layer of

taste and texture to your bibimbap. Don’t forget to add a dollop of gochujang (Korean red chili paste) and a drizzle of sesame oil, and mix well!

Spaghetti carbonara

Make this Italian dish the traditional way by skipping

the pre-packed mixes and making your own sauce from scratch. Carbonara

calls for a mixture of raw eggs, hard cheeses, and ground pepper for the

sauce, in which the freshly cooked pasta and fried pork (usually

guanciale or pancetta) are tossed into.

For your dish, you can either add corned beef in

straight from the can (it’s pre-cooked!) as substitute for the pork or

mix it in with strips of fried bacon.

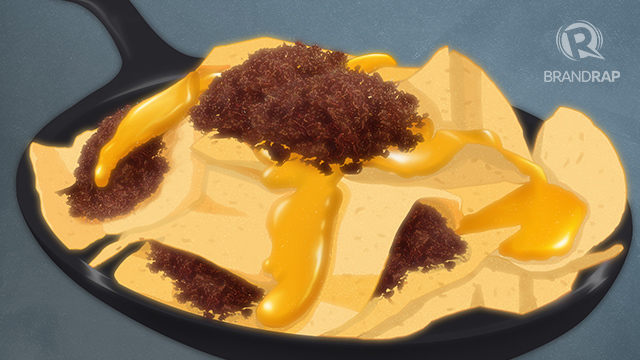

Nachos

Nachos is a fusion of American and Mexican cuisines, or

Tex-Mex. In this dish, a bed of crispy tortilla chips is topped with

sliced pickled jalapeño peppers and olives, beans, salsa, sour cream,

and melted cheese, among many other toppings.

Nachos usually call for ground pork, beef, or chicken, but feel free to make it your own by replacing it with fried corned beef.

Hamburgers

Hamburgers is an all-American dish, often enjoyed with

fries on the side. Its star is the patty, which is made by seasoning raw

ground beef with salt and pepper and forming into a disc-like shape,

then cooked by either grilling or frying.

For this version, make the patties as you would but use

corned beef. Pan fry your patties and when they’re done, sandwich one or

two in between a bun along with lettuce, tomato, and cheese.

Fried lumpiang shanghai rolls

Lumpiang shanghai, like corned beef, is a quintessential

Filipino favorite often served during birthdays, family reunions,

Christmas, New Year, and other occasions in between. So how about

combining two well-loved dishes to create a new one?

The traditional lumpia shanghai recipe calls for a

mixture of ground pork seasoned with salt and pepper, chopped carrots

and onions, and wrapped in lumpia wrappers. These are then deep fried

until golden brown to make sure the filling is fully cooked.

To give your lumpiang shanghai a new twist, use corned

beef! Mix it straight from the can and make the filling as you normally

would. The corned beef will give this old favorite a new flavor and

texture.

By simply opting for corned beef instead of pork, beef,

or chicken, you can easily add a new layer of smoky, beefy flavor and

texture to any of your favorite dishes.

Of course, the quality of your corned beef can affect

your dish. So make sure to cook your dishes with corned beef that’s made

from 100% premium Angus beef, which makes it juicier, tastier, firmer,

and more flavorful.

How do you plan to incorporate corned beef to your next meal? – Rappler.com

All illustrations by Raffy de Guzman.

Try the new Highlands Gold Corned Beef, the corned beef with Angus. Like

our Facebook page (link) to know more about Highlands Gold Corned Beef.

#AnguSarap

Duterte certifies tax reform bill as urgent

URGENT

MEASURE. President Rodrigo Duterte now wants the House of

Representatives to prioritize the tax reform bill before it adjourns

session this week. Malacañang file photo

MANILA, Philippines – President Rodrigo Duterte certified

as urgent House Bill (HB) Number 5636, which contains the first batch of

tax reforms being proposed by the Department of Finance (DOF).

Finance Assistant Secretary Paola Alvarez made the announcement on Monday, May 29, just 6 days since the House began the plenary deliberations on the Duterte tax reform package.

She said the President certified HB 5636 as urgent following the appeal of Finance Secretary Carlos Dominguez III.

This means the House may immediately subject the bill to

3rd reading once lawmakers approve it on 2nd reading any time this week.

Bills that are certified as urgent do not follow the "3-day rule"

between the 2nd and 3rd readings.

Alvarez, the daughter of Speaker Pantaleon Alvarez, quoted

a portion of Executive Secretary Salvador Medialdea's letter to her

father on Monday.

"We are transmitting this letter of President Rodrigo Roa

Duterte certifying to the necessity of the immediate enactment of House

Bill Number 5636 (the proposed Tax Reform for Acceleration and Inclusion

Act)," Alvarez quoted Medialdea as saying.

Alvarez also quoted part of a separate letter sent by Duterte to Senate President Aquilino Pimentel III.

"The benefits to be derived from this tax reform measure

will sustainably finance the government's envisioned massive investments

in infrastructure thereby encouraging economic activity and job

creation, as well as fund the desired increase in the public budget for

health, education, and social programs to alleviate poverty," said

Duterte.

Under HB 5636, the maximum rate of personal income tax

will be reduced over time from the current 32% to 25%, except for high

income earners. (READ: Duterte's tax reform: More take-home pay, higher fuel and auto taxes)

Those earning P250,000 or below annually will be exempted from paying income taxes. The mandated 13th month pay up to P82,000 as well as other bonuses will still be tax-free.

The "ultra-rich," who comprise 0.1% of taxpayers, will be levied a higher rate of 35% from the current 32%.

The measure, however, also proposes higher excise taxes on

refined petroleum products and automobiles, except for buses, trucks,

cargo vans, jeeps, jeepney substitutes, and special purpose vehicles.

An additional P10 tax per liter of volume capacity on

sugar-sweetened beverages and carbonated drinks will also be imposed.

(READ: FULL TEXT: Sugar-sweetened beverage taxes promise P47B revenue – Suansing)

HB 5636 also proposes the lifting of the value-added tax

exemptions for certain sectors, causing other lawmakers to tag the tax

package as "anti-poor."

The House leadership was originally targeting to have HB

5636 approved on 2nd reading before it adjourns session this week. But

Dominguez wanted the President to certify the measure as urgent so the

bill may be passed on 3rd reading as well.

Congress will resume session on July 24, the day Duterte will deliver his 2nd State of the Nation Address.

'Dire consequences' without tax reform bill

Dominguez warned there will be "dire consequences" if Congress does not pass the tax reform bill soon.

He reasoned HB 5636 was designed to support the Duterte administration's vision for a "golden age of infrastructure," attract investments, create jobs, cut the poverty rate from 21.6% to 14%, and transform the Philippines into an upper middle-income economy at the end of the President's term.

According to Dominguez, failure to pass HB 5636 into law would lead to an "unsustainable fiscal position."

"[This], in turn, could trigger a credit rating downgrade,

possibly costing the government an extra P30 billion in annual debt

servicing and P100 billion more in higher borrowing costs for the

public," he said.

A total of P157.2 billion in government revenues is

estimated to be generated from the tax reform package in its first year

of implementation alone. (READ: FULL TEXT: Revenue from tax reform to improve Filipinos' lives – Cua)

According to Dominguez, the money will be used to fund Duterte's infrastructure and social protection projects.

"To achieve these objectives, the administration plans to

increase the budget for infrastructure from P795 billion in 2016 to

P1.832 billion in 2022 to support the Golden Age of Infrastructure, the

budget for education from P551 billion to P1.269 billion, the budget for

health from P133 billion to P272 billion, and the budget for social

protection, welfare, and employment from P240 billion to P509 billion,"

he said.

"To sustainably finance these massive investments in

infrastructure and in the people, tax policy reform will be crucial

alongside tax administration and budget reforms," he added.

Read the full text of the letters sent by Duterte and Medialdea to Pimentel and Alvarez below:

– Rappler.com

Move, the civic engagement arm of Rappler, is crowdsourcing comments on, and recommendations for, nominees to the Duterte Cabinet.

You can post information and opinion on Salvador Medialdea on X.

You can post information and opinion on Salvador Medialdea on X.

Senate won't pass Malacañang's version of tax reform bill

TRUST

ECONOMIC TEAM. NEDA chief Ernesto Pernia urges lawmakers to trust the

country's economic managers when it comes to Malacañang's version of the

tax reform bill. Photo by Presidential Photo

MANILA, Philippines – Senators expressed opposition to Malacañang’s

version of the tax reform bill, and slammed National Economic and

Development Authority chief Ernesto Pernia for “pressuring” them to

approve the administration measure.Senator Juan Edgardo Angara, chair of the ways and means committee, said the imposition of higher taxes would affect the poor, as also voiced by the Department of Social Welfare and Development (DSWD).

“Eh kung sila [DSWD] kumokontra doon eh, kami sa Senado paano namin itutulak ang tax package kung nakakasama sa mahihirap ito?” Angara, who is eyeing reelection in the 2019 midterm polls, told reporters on Wednesday, May 31.

(If DSWD is opposing it, how can the Senate push for a tax package that harms the poor?)

Angara and Senate President Pro-Tempore Ralph Recto said they would pass the measure but with major revisions. Under the law, tax measures should emanate from the House before they are transmitted to the Senate.

“I think we can come up with a measure in the next few months. It’s just that it may not be exactly what's being pushed by the executive,” Angara said.

Recto said: “I'm sure we will pass something but it doesn't mean...everything the executive wants ay ibibigay (will be given). But I'm sure madaming mababago pa diyan (there will be a lot of amendments there).”

On Tuesday, May 30, the NEDA chief criticized the House of Representatives for passing a watered-down tax reform measure. If Congress would not pass the executive’s version in full, Pernia said the planned infrastructure boom would not happen. (READ: Duterte's tax reform: More take-home pay, higher fuel and auto taxes)

Duterte has earmarked P8 trillion to build new roads, airports, and railways to sustain the growth of the economy.

“It’s not going to be the golden age of infrastructure. It will be the bronze age, maybe, of infrastructure, or maybe dark age of infrastructure. So that is how terrible, that is how unwelcome ,the non-passage of the [comprehensive tax reform program] is going to be,” Pernia said in a press conference in Malacañang.

“There’s a problem, then we will be unable to fund the build, build, build. It will be small build, small build, small build….Maybe no build, no build, no build,” he added.

This did not sit well with Angara, who said Pernia is setting up Congress for failure.

“Yeah, we don’t appreciate that pressure coming from the executive branch because we’re doing our best here. It seems we’re being set up for failure eh kumbaga kung di pinasa gusto nila kasalanan namin kung bumagsak ang ekonomiya (it's like if we don't pass it, the collapse of the economcy would be our fault)," he said.

"Bakit kami ba nasa manibela? Sila may hawak ng manibela, nakasakay lang kami doon, 'di ba? (Are we the ones behind the wheel? They are the ones driving, we are just passengers, right)” Angara said.

Angara also pointed out that the administration of then president Benigno Aquino III was able to achieve economic growth with just raising excise taxes on alocohol and tobacco.

“That’s not true because the Aquino administration was able to build a lot of infrastructure, able to grow the economy by 6% with only raising sin taxes. Bakit di nila kaya 'yun (Why can't they do that)?” he said.

'Arrogance'

Senate Minority Leader Franklin Drilon also slammed Pernia for urging lawmakers to listen to and "trust" the economic team more because the senators “are not as well-versed" on the matter.

“Labingsiyam na taon na ako ritong tumitingin ng budget (I have been scrutinizing the budget for 19 years). I do not claim expertise but certainly we know something about the budget. I find that arrogant. Ang yabang naman niya (He's so arrogant). Such arrogance,” Drilon told reporters.

Recto, for his part, said, "Patunayan din nila expert sila para gastusin yung pera (They should also prove that they are experts when it comes to spending money)."

Pernia on Tuesday said Congress should realize that the economic team knows what is “best and optimal” for the country and has “no personal agenda.”

“Congress should have passed it in toto. Because, you know, they should realize that we in the economic team, our interest is really just the country’s development, the improvement of society. We have no personal agenda at all. And we are trained to do economic analysis, tax analysis, as we know what is best, what is optimal. So that is my message really," Pernia said.

“And, you know, I don’t think the legislators are as well versed as the economic team is. I mean, the legislators as a whole, some of them may be experts but not all of them; and they work as a whole. And the economic team also works as a whole and therefore, you know, they should have more trust in the economic team," he added.

Prove spending capacity first

Recto, a former NEDA chief, said the government should first prove it could spend its budget before seeking new taxes.

“Well, ang una ko masasabi, titingnan sa debate diyan kung nagastos ba nila at nagagastos ba nila budget sa taon na ito kasi kung di rin nila nagagastos at mahina absorptive capacity, bakit kailangan ng new taxes? Aanhin mo 'yung pera kung di mo magastos?" Recto said.

(First, what I can is that in the debate, we will see if they had spent and are spending their budget for this year because if not, and the absorptive capacity is weak, why the need for new taxes? What will you do with the money if you can't spend it?)

He also questioned the disparity between the amount of tax relief the public will get and the additional taxes they will pay.

“Madami issues diyan, paulit-ulit ko na sinasabi ito. Halimbawa ang ibabalik to your left pocket by way of an income tax reduction ay P200, pero kapalit noon kukuha ng P500 billion sa kabilang pocket mo naman. Neto sila ng P300 billion. So panalo ka ba doon?” Recto asked

(There are a lot of issues there, I keep on saying this. For example, what you will put in your left pocket by way of income tax reduction is P200, but in exchange, they will get P500 from your other pocket. Their net will be P300 billion. Will you win in that case?)

PHILLIPINES Students urge undecided senators to back proposed tobacco tax hike

![PHILLIPINES Students urge undecided senators to back proposed tobacco tax hike]() Reviewed by Martbiz.blospot.com

on

November 22, 2017

Rating:

Reviewed by Martbiz.blospot.com

on

November 22, 2017

Rating:

No comments: